SEC Considers an Innovative Capital Raising Resource for Small Businesses: Unlicensed Money Finders

Raising capital is one of the most critical challenges faced by entrepreneurs and local real estate developers. Capital is the “wind in the sails” required to move any enterprise forward. While many emerging companies rely on friends and family for initial funding, seed capital rarely can accomplish more than getting a business idea off the ground. Founders need to dramatically scale up their business in order to get the attention of venture capitalists or registered broker-dealers for larger rounds of funding. There is a systemic gap between raising money from those in your immediate circle and raising larger rounds of funding with seasoned investors. Unlicensed, unregistered finders have stepped in to fill this gap despite the potential legal pitfalls involved. Under current securities law, only registered broker-dealers are allowed to take transaction-based compensation (i.e. a success fee based on the amount of money raised). Among other limitations, unregistered finders must be paid a flat fee that is not tied to the amount of funds they generate, which is problematic for many practical reasons. Entrepreneurs risk sanctions, possible rescission of offerings and other penalties in order to enter into transaction-based fee arrangements with unregistered finders to raise the capital they so desperately need.

However, in this age of Covid and the desperate need to inject capital into small businesses across the nation, the SEC is considering relaxing its prohibition on success fees for finders. Last month, the Securities and Exchange Commission voted to propose a limited, conditional exemption from broker registration requirements for unregistered finders. If adopted, the proposed exemption would permit individuals (not companies) to engage in certain limited activities involving accredited investors without registering with the SEC or FINRA as brokers. The proposed exemption seeks to assist small businesses to raise capital and to provide regulatory clarity to investors, companies, and the finders who assist them.

The Proposed “Finders” Exemption

The proposal would create two classes of finders, Tier I Finders and Tier II Finders, that would be subject to conditions based on the scope of their respective activities. The proposed exemption would establish guidelines for limited activities by finders that would be exempt from registration. Tier I and Tier II Finders would both be permitted to accept transaction-based compensation under the terms of the proposed exemption.

Tier I Finders

A Tier I Finder would be limited to providing contact information of potential investors in connection with only a single capital raising transaction by a single company in a 12-month period. A Tier I Finder could not have any contact with a potential investor about the company.

Tier II Finders

A Tier II Finder could solicit investors on behalf of an company, but the solicitation-related activities would be limited to: (i) identifying, screening, and contacting potential investors; (ii) distributing company offering materials to investors; (iii) discussing company information included in any offering materials, provided that the Tier II Finder does not provide advice as to the valuation or advisability of the investment; and (iv) arranging or participating in meetings with the company and investor.

Conditions for Both Tier I and Tier II Finders

Both Tier I and Tier II Finders would be subject to certain conditions. The proposed exemption for Tier I and Tier II Finders would be available only where:

-

the company is not publicly traded;

-

the company is seeking to conduct the securities offering in reliance on an applicable exemption from registration under the Securities Act;

-

the Finder does not engage in general solicitation;

-

the potential investor is an “accredited investor” as defined in Rule 501 of Regulation D or the Finder has a reasonable belief that the potential investor is an “accredited investor”;

-

the Finder provides services pursuant to a written agreement with the company that includes a description of the services provided and associated compensation;

-

the Finder is not associated with a broker-dealer; and

-

the Finder is not a “bad actor” as described in Section 3(a)(39) of the Exchange Act.

A Finder could not rely on this proposed exemption to engage in broker activity beyond the scope of the proposed exemption. For example, a Finder could not (i) be involved in structuring the transaction or negotiating the terms of the offering; (ii) handle customer funds or securities or bind the company or investor; (iii) participate in the preparation of any sales materials; (iv) perform any independent analysis of the sale; (v) engage in any “due diligence” activities; (vi) assist or provide financing for such purchases; or (vii) provide advice as to the valuation or financial advisability of the investment.

Additional Conditions for Tier II Finders

Because Tier II Finders could participate in a wider range of activity and have the potential to engage in more offerings with companies and investors, the Commission has proposed additional, heightened requirements. A Tier II Finder wishing to rely on the proposed exemption will also be required to provide a potential investor, prior to or at the time of the solicitation, certain disclosures that include:

-

Their name and the name of the company;

-

The description of their relationship with the company, including any affiliation;

-

A statement that they will be compensated for their solicitation activities by the company and a description of the terms of such compensation arrangement;

-

Any material conflicts of interest resulting from their arrangement or relationship with the company; and

-

An affirmative statement that they are acting as an agent of the company, are not acting as an associated person of a broker-dealer, and are not undertaking a role to act in the investor’s best interest.

These disclosures must be made prior to or at the time of the solicitation. Further, the Tier II Finder must obtain from the investor, prior to or at the time of any investment in the company’s securities, a dated written acknowledgment of receipt of the required disclosures. Furthermore, finders would still be obligated to comply with all other applicable laws, including the antifraud provisions of the Securities Act and the Exchange Act and any applicable state “blue sky” laws.

Why it Matters – Sustainable, Locally Sourced Fund Raising

“Many small businesses face difficulties raising the capital that they need to grow and thrive, particularly when they are located in places that lack established, robust capital raising networks,” said SEC Chairman Jay Clayton. “Particularly in these ecosystems, finders may play an important role in facilitating capital formation for smaller companies. If adopted, the proposed relief will bring clarity to finders’ regulatory status in a tailored manner that addresses the capital formation needs of certain smaller companies while preserving investor protections.” Commissioner Elad. L. Roisman noted that “small businesses and entrepreneurs historically have been underserved by venture capital funding or angel investors, either due to their geographic location or founder demographics.”

Geographic Impacts on Capital Raises

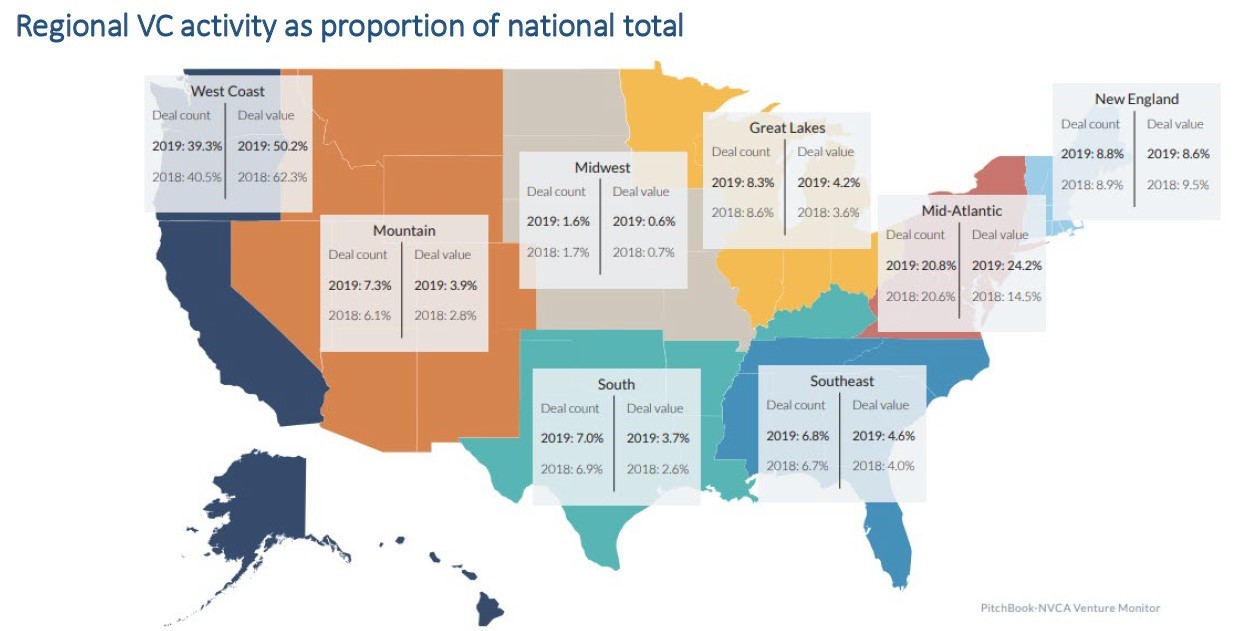

According to James Gelfer, the Senior Strategist and Lead Venture Analyst at PitchBook1, Venture Capital activity on the West Coast and in the Northeast (not including New England) accounted for over 50% of the deals funded and almost 75% of the venture capital raised in the United States in 2019.

The map above clearly reveals that many regions in the United States are underserved by our current capital fund raising systems. Mr. Gelfer’s report also reports that the median distance between a lead investor in an early stage Angel/Seed round and the target company was only 92.4 miles in 2019. While it is encouraging that this is up from 65.5 miles in 2018, the take-away is clear. Early stage investors clearly prefer to invest in entrepreneurs who are close to where they live, and many of these investors live in California, New York and the Washington DC metropolitan areas.

Demographic Impacts on Capital Raises

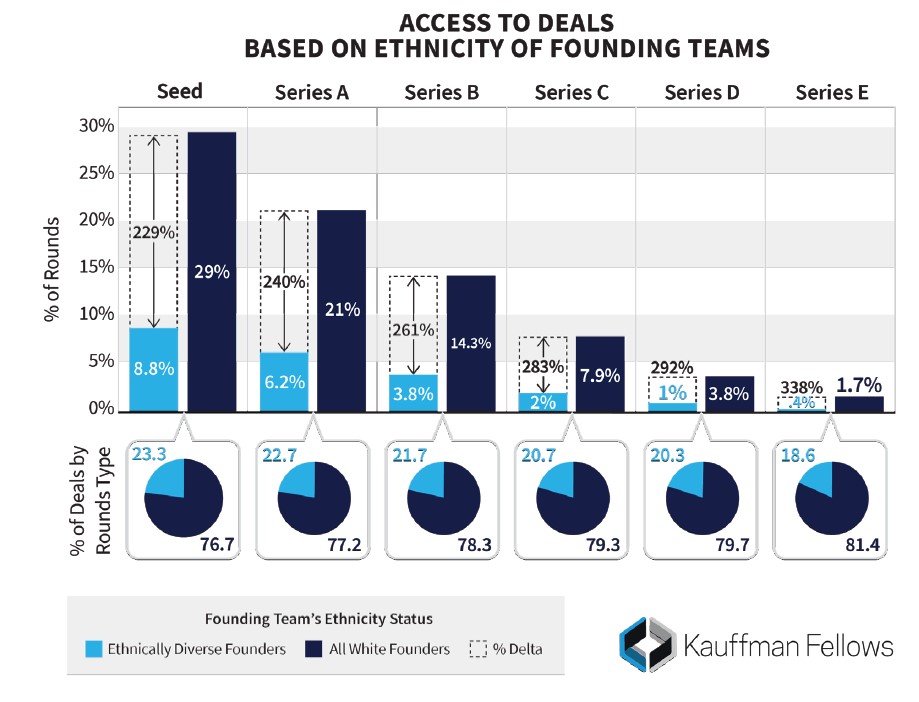

The demographics of who is getting funded paint a similar disparate picture. According to Mr. Gelfer’s research, female founded companies comprised only 6.8% of the deals funded and received only 2.7% of the venture capital raised in the United States in 2019. Relatedly, according a joint report authored by Kauffman Fellows Research Center and MaC Venture Capital2, minority founded companies have much more limited access to capital than white founding teams. Their data shows, after taking into account disproportionate representation, that more than 75% of all financing rounds are raised by white founding teams.

The “Unregistered Finders” Solution

Potential unregistered finders are everywhere. For example, they can be found leading church groups, community and business centers, civic organizations, fraternities and sororities, mommy- and daddy-groups, even book clubs and of course, investment clubs. This proposed exemption provides additional incentive for these local leaders to connect their affinity groups with (i) entrepreneurs who have devised products or services that resonate with their organization, or (ii) local real estate developers with projects geared towards revitalizing their community.

Furthermore, respected business leaders with deep networks might consider becoming a Tier II finder, to leverage their connections to fund emerging local companies. As evidenced by the research above, the current venture capital fundraising prospects for entrepreneurs in most of the country are low, and more so for women and minorities. Recognizing this, Chairman Clayton and Commissioner Roisman are advocating for the regulation of unregistered finders, who are expected to deliver start-up capital into businesses throughout the United States. Such funding would benefit local economies at a time when neighborhood businesses are being devastated by the pandemic.

If you are an entrepreneur or real estate developer seeking capital or a potential finder, feel free to contact the author of this article or your CSG attorney for additional information.

1 Presentation at Feb. 4, 2020 Small Business Capital Formation Advisory Committee meeting, available here.